Content Delivery Chain Trends and Evolution

This blog is third in a series of three blogs related to Content Distribution. The first can be found here.

In the previous posts, the various parties required to move data along the content delivery chain have been reviewed. In this post, we examine the main trends in the content delivery chain and how the role of some parties is evolving.

As for the previous posts, we have assumed contents produced/stored in the US and end-users based in France. The Figure below illustrates some ongoing and potential trends in this content delivery chain. Depending on the geographic markets considered, some of the trends described in this post have already happened, while others may or may not happen.

Ongoing and potential trends in the content delivery chain

Various trends can be observed between the different parties involved in the content delivery chain.

- In order to get closer to end customers and improve the resilience and quality of experience for their services, some large content providers are deploying their own long-haul transport network infrastructure (including submarine cable systems) and their own Content Delivery Network (CDN) platforms. These large content providers partner with Internet Service Providers (ISPs) for the last mile to reach end-users.

This approach is followed by, e.g., Google and Facebook that (co-)build subsea cable systems (this does not prevent, however, them from buying dark fiber pairs or capacity on other transport infrastructure to increase connectivity/reach/diversity of their own networks). - In addition to their transit services, some transit providers use their existing infrastructure to develop CDN products and host/deliver third-party content.

- On one hand, CDN operators can behave more and more like transit network operators by deploying their own (bought or built) infrastructure around the globe. On the other hand, they are establishing partnerships with ISPs to deploy their servers on the latter’s network and be as close to end-users as possible.

- Some ISPs can diversify their businesses by creating their own content and distributing it themselves through their own platforms.

Example of Content Delivery Chain for a Website

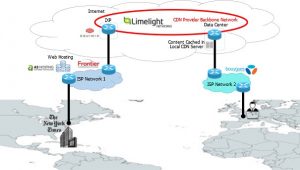

This example illustrates the content delivery chain for small content providers that do not invest in their own transport and delivery infrastructure (given the amount of data moved, this would make no economic sense for them to build their own network). The content of the New York Times newspaper is hosted on servers operated by a hosting service provider (A2 Hosting) in the US.

Example of a CDN operator offering also transport service via capacity leased over a trans-Atlantic cable system

Using Frontier Communications as an Internet service provider, the A2 hosting servers are connected to a Content Delivery Network (CDN) operated by Limelight Networks. The interconnection can happen in an Internet eXchange Point (IXP) housed in a data center operated by, e.g., Equinix, where Frontier Communications’ network is interconnected to a trans-Atlantic cable system on which Limelight Networks has bought some capacity to Europe.

Limelight Networks’ transport infrastructure moves the New York Times website content to a caching server located in France.

A French Internet service provider (e.g., Bouygues Telecom) interconnects with Limelight Networks’ caching server in an edge data center and routes the New York Times website content to its final destination upon end-user’s request.

Option for Delivering Google’s Content

For large content providers, it can make sense to invest, build and control their own transport and delivery infrastructure for economics, operational and service quality reasons. In the figure below, Google’s data center on the East Coast of the US is directly connected to a Google-owned trans-Atlantic cable system.

Example of a content provider controlling a large part of the delivery chain

Google content is made available in west Europe in a Google’s Point of Presence (PoP), connected with a regional network operated by Google (typically using managed capacity services purchased from regional operators). Google’s regional transport network moves the Google content from the regional PoP to a local Google Global Cache server in France close to the end-user.

A French Internet service provider (Bouygues Telecom) interconnects with the local Google Global Cache server and routes Google’s content to its final destination upon end-user’s request.

This last example shows how large content providers can bypass some parties in the content delivery chain, especially when the desired transport and delivery networks are not offered by the “traditional” network operators.

For comments or questions, please contact us.